2022 tax brackets

Each of the tax brackets income ranges jumped about 7 from last years numbers. 77400 to 165000 22.

2022 Income Tax Brackets And The New Ideal Income

Tax on this income.

. In the American tax system income tax rates are graduated so you pay different rates on different amounts of taxable income called tax. 18 rows Income tax If taxable income is over But not over The tax is Of the amount over. 1 day agoSo for example the lowest 10 ordinary income tax bracket will cover the first 22000 of taxable income for a married couple filing jointly up from 20550 in 2022.

The agency says that the Earned Income. Tax brackets for income earned in 2022 37 for incomes over 539900 647850 for married couples filing jointly 35 for incomes over 215950 431900 for. 2022 Tax Bracket and Tax Rates.

9 minutes ago2023 tax brackets. 8 rows 2022 Federal Income Tax Brackets and Rates In 2022 the income limits for all tax. 10 12 22 24 32 35 and 37.

Find out your 2022 federal income tax bracket with user friendly IRS tax tables for married individuals filing joint returns heads of households unmarried individuals married individuals. Taxable income between 10275 to 41775. April 17 2023 Single.

How the brackets work. There are seven federal tax brackets for the 2021 tax year. For 2018 they move down to the 22 bracket.

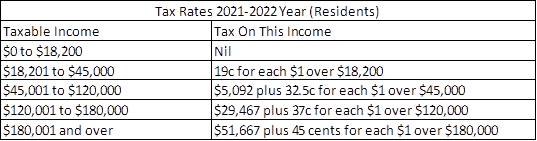

There are still seven tax rates in effect for the 2022 tax year. Resident tax rates 202223. Federal Income Tax Brackets 2022 The taxable income rate for single filers earning up to 10275 is 10 percent and for joint married filers is 10 percent tax on income up.

This means that these brackets applied to all income earned in 2021 and the tax return that uses these tax. 22 hours agoThe Internal Revenue Service has released a list of inflation adjustments impacting more than 60 tax provisions including tax brackets deductions and credits. 2022 tax brackets for taxes due in April 2023 announced by the IRS on November 10 2021 for individuals married filing jointly married filing separately and head of household.

These are the rates for. 1 day agoThe IRS will exempt up to 1292 million from the estate tax up from 1206 million for people who died in 2022 an increase of 71. Heres how they apply by filing status.

Taxable income up to 10275. The seven brackets remain the same next year 10 12 22 24 32 35 and 37 which were set after the 2017 Tax Cuts and Jobs ActThese will be in. 19 hours agoThe IRS will slap a 12 marginal tax on individual filers earning more than 11000 and on joint married filers earning over 22000.

Federal Income Tax Bracket for 2022 filing deadline. For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539900 647850 for married couples filing. Trending News Abbott recalls more baby.

Taxable income between 41775 to 89075. 10 12 22 24 32 35 and 37. Heres a breakdown of last years.

18 hours ago2022 tax brackets for individuals. When it comes to federal income tax rates and brackets the tax rates themselves didnt change from 2021 to 2022. There are seven tax rates in 2022.

They dropped four percentage points and have a fairly. 7 rows The federal tax brackets are broken down into seven 7 taxable income groups based on your. 75901 to 153100 28.

Your bracket depends on your taxable income and filing status.

How Tax Brackets Work 2022 Tax Brackets White Coat Investor

Tax Brackets Canada 2022 Filing Taxes

Tax Season 2022 Tax Brackets Irs Forms Deadlines Pdffiller Blog

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

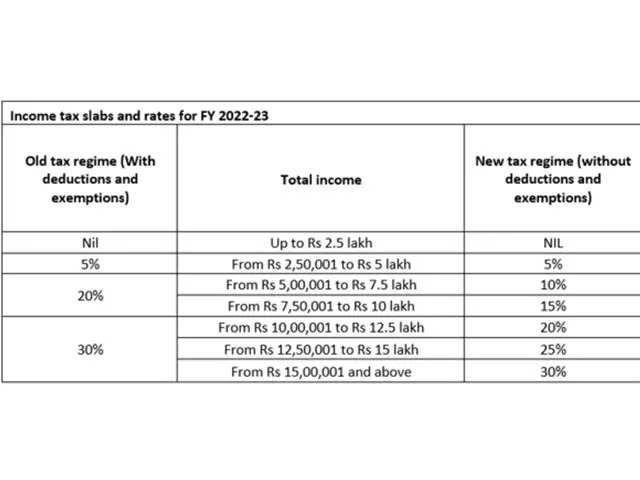

Budget 2022 Maintains Status Quo On Income Tax Rates Taxpayers Pay As Per These Slabs No Change In Personal Income Tax Slabs The Economic Times

2022 Tax Brackets How Inflation Will Affect Your Taxes Money

2021 2022 Tax Brackets And Federal Income Tax Rates Bankrate

Ato Tax Time 2022 Resources Now Available Taxbanter

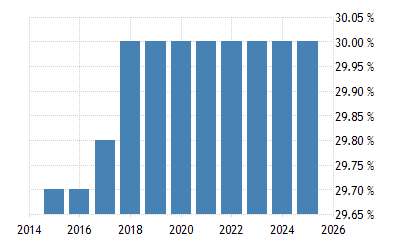

Germany Corporate Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical Chart

2021 2022 Federal Income Tax Brackets And Rates

Uk Income Tax Rates And Bands 2022 23 Freeagent

State Income Tax Rates And Brackets 2022 Tax Foundation

2022 2023 Tax Brackets Standard Deduction Capital Gains Etc

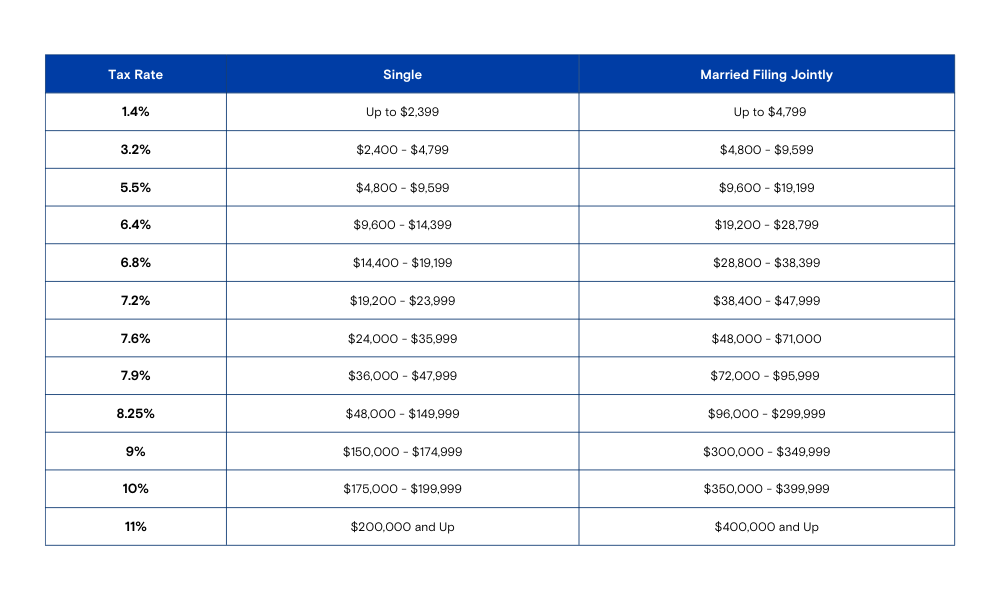

What S The Racket About Tax Brackets A Look At How Tax Brackets Work Bank Of Hawaii

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Nyc Property Tax Rates For 2021 2022 Rosenberg Estis P C

Everything You Need To Know About Tax In Australia Down Under Centre